Total profit percentage formula

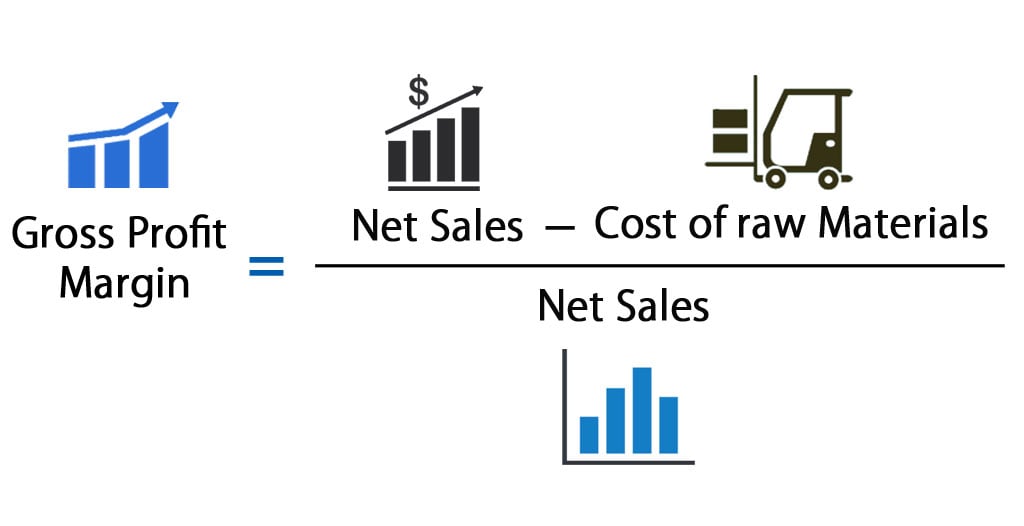

FAQs on How To Calculate Percentage. The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service.

Profit And Loss Formula Examples Derivation Faqs

The Percentage Formula is given as.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

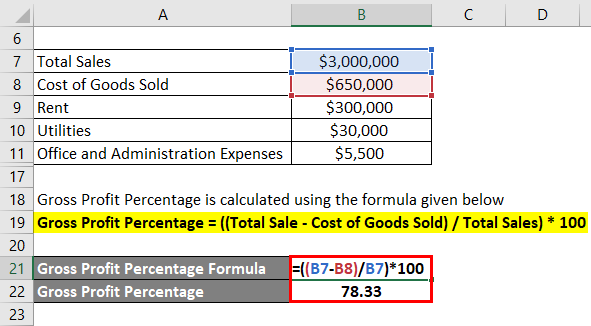

. In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Gross profit is equal to net sales minus cost of goods sold. It is defined as a number represented as a fraction of 100.

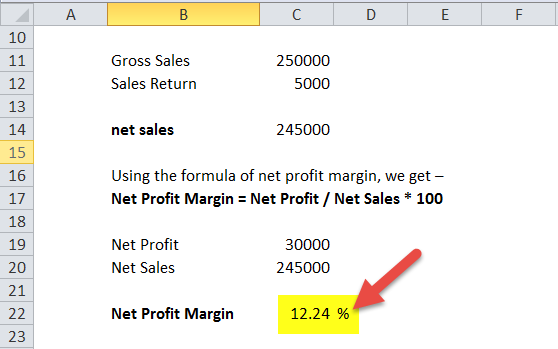

After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. Formula to Calculate Percentage. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales.

Net profit includes all the cost amount generated by the business as revenue. In the example shown the formula in cell E5 is. The gross profit margin is the gross profit over the revenue.

The optimal percentage for gross profit is 30 or higher. Ie 20 means the firm has generated a. In the Column field.

Therefore P 50150. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below. In its simplest form percent means per hundred.

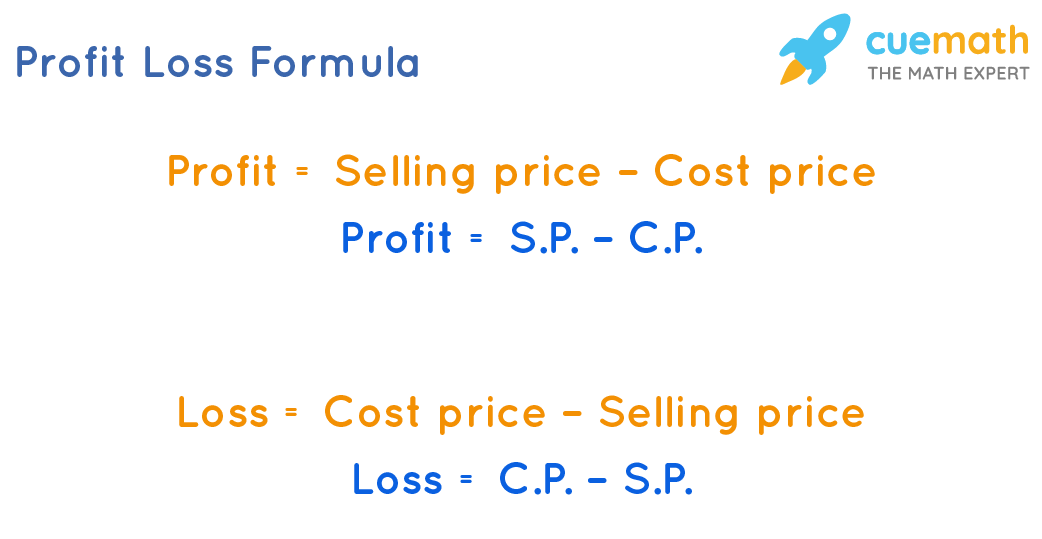

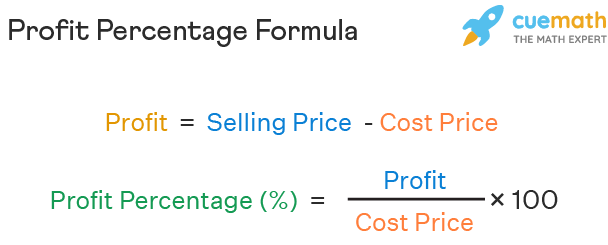

It is denoted by the symbol and is majorly used to compare and find out ratios. Profit and Loss Percentage Formula from Cost price and Sell Price. Profit Total Sales Total Expense.

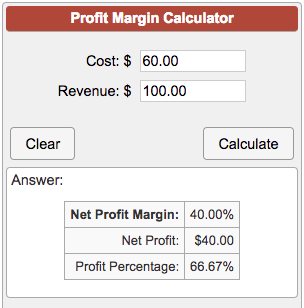

When the price of a commodity is lower than the par value stated value or face value it results in a discount. To calculate profit margin as a percentage with a formula subtract the cost from the price and divide the result by the price. More simply the net profit margin turns the net profit or bottom line into a percentage.

Whats the whats the formula for excel to get the total percentage for both. Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. Power bi show value as percentage in matrix.

The gross profit margin helps in measuring a companys efficiency in production over a period of time. Now - LCost is 135 5819 7856 1357856213. In this method we will use the mathematical formula subtraction to simply get the result of profit or loss and then use percentage formatting from the Number Format ribbon.

This is the total profit of business. The percentage formula will help to identify the difference in terms of increase and decrease of the formula. Profit Margin Total Income Net Sales x 100.

So 20 here is nothing but 02x and total SP will be x 02x 12x. Since P 50 and CP 150. Typically expressed as a percentage net profit margins show how much of each dollar collected by a.

In this example the goal is to work out the percent of total for each expense shown in the worksheet. Percentage Gain means to express the profit or the gain in the form of percentages. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so.

Learn a quick way to calculate percentage in Excel. Calculating net profit requires deducting the following from the companys total revenue. In power bi desktop select the matrix visual from the visualization pane.

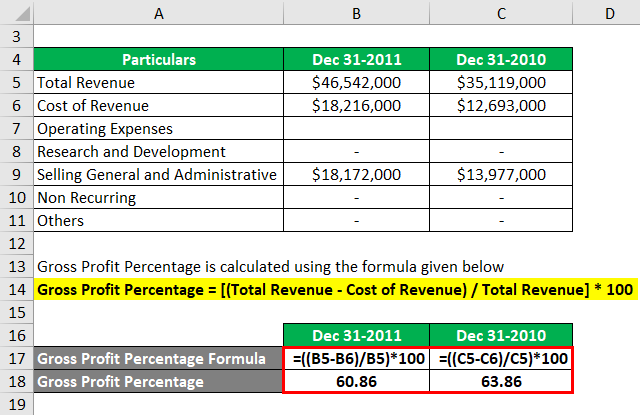

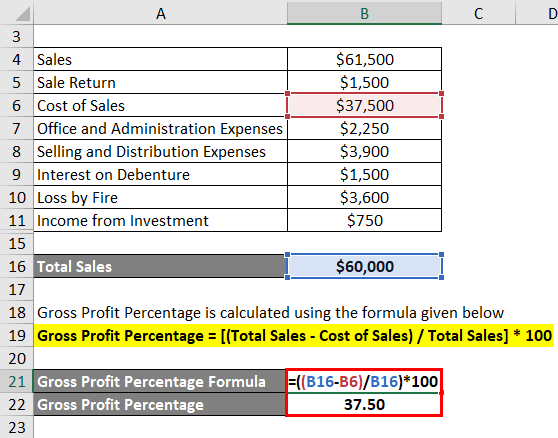

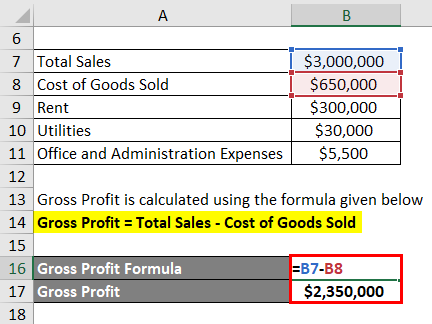

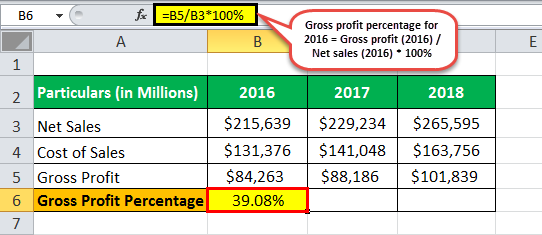

The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. Net Profit Margin Formula. By the profit percentage formula we know P PCP 100.

It represents the actual sum of money made by any business. Relevance and Use of Profit Percentage Formula. Read Power bi Date Difference 8 Different Examples.

It measures the ability of the firm to convert sales into profits. SUM C6C14. Gross Profit Margin Formula.

This standard percentage is sufficient to cover most business taxes and other expenses. The total already exists in the named range total C15 which contains a formula based on the SUM function. Gross margins must remain high to afford operating expenses.

Using the above formula Company XYZs net profit margin would be 30000. Profit margin is calculated with selling price or revenue taken as base times 100. Also Operating Profit Margin Operating Profit Total Sales.

How To Calculate Discount. In other words given that we know the total is 1945 and. And the percentage gain formula makes it easier and faster for a person to understand the variables or the vitals of a business transaction.

Because of percentage to decimal conversion. Businesses use this amount as an indicator of their profit before expenses. First click on cell E5 and type the following formula.

Here we will see how to show value as percentage in matrix visual in power bi desktop. Net profit margin is the ratio of net profits to revenues for a company or business segment. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65.

In other words given a price of 500 and a cost of 400 we want to return a profit margin. Gross profit percentage formula Total sales Cost of goods sold Total sales 100. Net sales are equal to total gross sales less returns inwards and discount allowed.

ABC is currently achieving a 65 percent gross profit in her furniture business. Profit percentage is a top-level and the most common tool to measure the profitability of a business. The formula of gross profit margin or percentage is given below.

In the Row field drag and drop the Category and segment column from the field pane. Use the gross profit formula to find out the total gross profit ie Gross Profit Revenue - Cost of goods sold. Formula examples for calculating percentage change percent of total increase decrease a number by per cent and more.

To express a number between zero and one percentage formula is used.

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Percentage Formula Examples With Excel Template

Profit Percentage Formula Examples With Excel Template

Profit Percentage Formula Examples With Excel Template

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit Margin Calculator

Net Profit Margin Definition Formula How To Calculate

Gross Profit Calculator Deals 51 Off Www Wtashows Com

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Net Percentage Calculator Flash Sales 60 Off Www Ingeniovirtual Com

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Percentage Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Profit Percentage Formula Examples With Excel Template

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Formula What Is Profit Formula Examples Method